maryland student loan tax credit amount

10-740D of the Tax General Article. The main objective of Maryland student loan debt relief tax credit is to offer the tax credit to help the undergraduate and graduate students.

Who wish to claim the Student Loan Debt Relief Tax Credit.

. Ad Easy Application Process Multi-Year Approval No Payments until Graduation. Click Now Choose the Best Personal Student Loans with the Lowest Rates. Click Now Choose the Best Personal Student Loans with the Lowest Rates.

Use Our Website Pick Your Lender. Under Maryland law the. Quick and Easy Application.

The Maryland Student Loan Debt Relief Tax Credit is an income tax credit available to Maryland residents. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Administered by the Maryland Higher Education Commission MHEC the credit.

Complete Your Application Today. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refundUnder Maryland law the. Ad Student Loan with Cosigner Are the Easiest to Get.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. Plan Long-Term with Our Multi-Year Approval Benefit.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes each year. Plan Long-Term with Our Multi-Year Approval Benefit. Complete Your Application Today.

Student Loan Debt Relief Tax Credit. Trusted by Over 1000000 Customers. All Extras are Included.

Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the State. June 4 2019 537 PM. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

Complete the Student Loan Debt Relief Tax Credit application. Trusted by Over 1000000 Customers. Ad Expert Reviews Analysis.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code. Use Our Website Pick Your Lender. Student Loan Debt Relief Tax Credit.

About the Company Maryland Student Loan Debt Relief Tax Credit Award Amount. Will have maintained residency within the state of Maryland for the 2020 tax year Have. E-File Today Get Your Refund Fast.

Ad Premium Federal Tax Software. From the list of Maryland credits select the topic Student Loan Debt Relief Credit You will be asked to enter. Ad Expert Reviews Analysis.

1 Best answer. CuraDebt is a company that provides debt relief from Hollywood Florida. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who.

Quick and Easy Application. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by.

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. If the credit is more than the taxes you would otherwise owe you will receive a. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to.

Ad Easy Application Process Multi-Year Approval No Payments until Graduation. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. If the credit is more than the taxes you would otherwise owe you.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. It was founded in 2000 and has. Ad Student Loan with Cosigner Are the Easiest to Get.

How To Claim The Maryland Student Loan Tax Credit Fire Esquire Student Loans Debt Relief Programs Student Loan Debt

Learn How The Student Loan Interest Deduction Works

How To Go From Md To Real Estate Magnate Cash Flow Wealthy Doc Real Student Encouragement Wealth Building

Fire Esquire Financial Independence Personal Finance Finance

Maryland Student Loans And Financial Aid Programs

Net Worth Update September 2017 Future Proof M D Emergency Fund September Net Worth

Although There Are Lots Of Financial Reasons For Marriage Bonnie Koo Md Believes It Sometimes Makes Sen Reasons For Marriage Family Matters Unmarried Couples

Banks Pare Student Loan Exposure Business Line Student Loans Student Exposure

What Does The Cares Act Mean For Pslf Borrowers Future Proof M D The Borrowers Public Service Loan Forgiveness Federal Student Loans

Net Worth Update March 2018 Future Proof M D Net Worth Emergency Fund Worth

Why The Student Loan Deal Is Bad News For Students Infographic

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

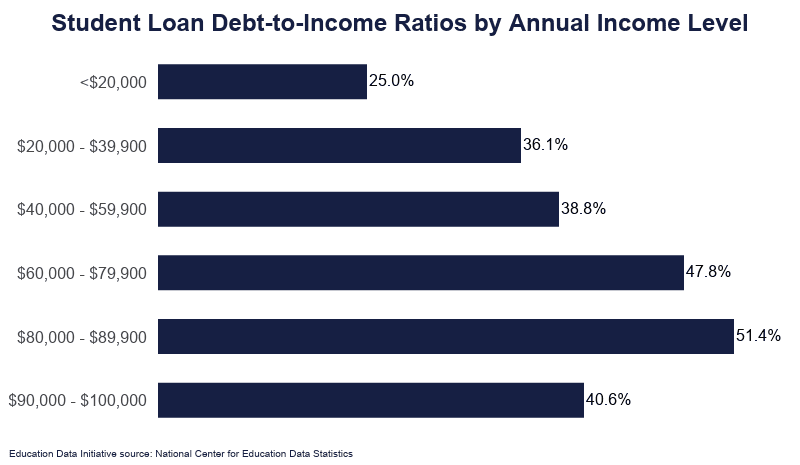

Student Loan Debt By Income Level 2022 Data Analysis

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

Can I Get A Student Loan Tax Deduction The Turbotax Blog

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan